San Diego Home Insurance Can Be Fun For Anyone

Wiki Article

Secure Your Comfort With Reliable Home Insurance Plan

Why Home Insurance Is Vital

The value of home insurance policy depends on its capacity to give monetary security and comfort to property owners despite unanticipated events. Home insurance acts as a safety net, offering protection for damages to the physical structure of the residence, individual possessions, and obligation for mishaps that may occur on the home. In case of all-natural catastrophes such as quakes, floodings, or fires, having a thorough home insurance coverage policy can aid property owners reconstruct and recoup without facing considerable economic concerns.Furthermore, home insurance is usually needed by home mortgage lenders to shield their financial investment in the building. Lenders intend to make sure that their financial passions are protected in situation of any damage to the home. By having a home insurance plan in position, property owners can accomplish this requirement and secure their investment in the property.

Sorts Of Protection Available

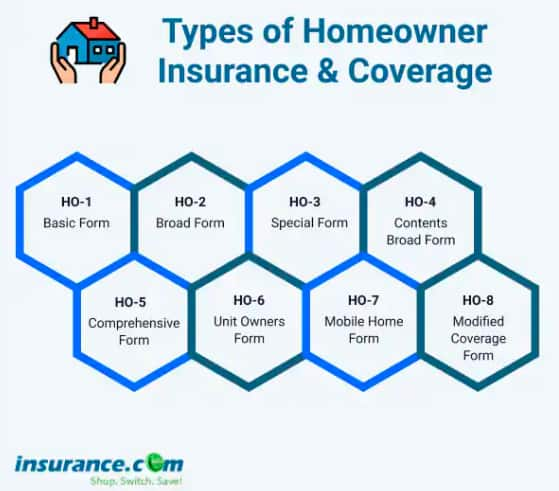

Provided the significance of home insurance in shielding home owners from unanticipated economic losses, it is important to comprehend the various kinds of coverage offered to tailor a policy that suits private needs and scenarios. There are several essential types of protection supplied by most home insurance policies. Personal property protection, on the other hand, safeguards possessions within the home, including furnishings, electronics, and clothing.Variables That Influence Premiums

Aspects affecting home insurance coverage costs can differ based on an array of factors to consider particular to individual circumstances. Older homes or homes with out-of-date electrical, plumbing, or home heating systems may present higher threats for insurance policy companies, leading to greater premiums.In addition, the protection limitations and deductibles selected by the policyholder can affect the premium amount. Going with greater coverage limitations or lower deductibles generally results in greater costs. The type of building and construction products made use of in the home, such as timber versus brick, can likewise impact costs as certain products might be a lot more vulnerable to damages.

Just How to Select the Right Plan

Selecting the proper home insurance plan involves careful factor to consider of different crucial elements to make certain detailed coverage tailored to individual needs and situations. To start, assess the value of your home and its components accurately. Next off, take into consideration the different types of coverage readily available, such as dwelling insurance coverage, personal residential or commercial property insurance coverage, responsibility defense, and extra living expenses coverage.Additionally, examining the insurance firm's online reputation, economic stability, customer support, and asserts procedure is critical. Try to find insurers with a history of reliable solution and prompt cases settlement. Lastly, compare quotes from several insurers to find an equilibrium in between cost and coverage. By meticulously examining these variables, you can choose a home insurance coverage that provides the necessary defense and assurance.

Benefits of Reliable Home Insurance Coverage

Reliable home insurance coverage supplies a sense of security and protection for home owners versus unexpected events and financial losses. Among the essential advantages of reputable home insurance is the assurance that your residential property will certainly be covered in case of damage or destruction triggered by natural calamities such as fires, tornados, or floodings. This protection can help home owners stay clear of birthing the full cost of repair services resource or restoring, offering tranquility of mind and economic stability throughout difficult times.Furthermore, trustworthy home insurance plan often include liability protection, which can protect homeowners from lawful and medical expenditures when it comes to mishaps on their home. This insurance coverage prolongs beyond the physical framework of the home to secure versus lawsuits and cases that may develop from injuries endured by visitors.

Additionally, having reputable home insurance coverage can additionally add to a sense of total well-being, understanding that your most considerable investment is protected versus different threats. By paying regular premiums, house owners can mitigate the prospective economic concern of unanticipated events, enabling them to focus on enjoying their homes without consistent fret about what may occur.

Conclusion

Finally, safeguarding a trusted home insurance plan is important for shielding your home and possessions from unanticipated events. By recognizing the sorts of coverage available, elements that influence costs, find out here and exactly how to choose the best plan, you can ensure your tranquility of mind. Relying on in a reliable home insurance provider will certainly offer you the advantages of financial security and safety and security for your most useful property.Navigating the world of home insurance can be complex, with numerous coverage alternatives, plan factors, and factors to consider to weigh. Understanding why home insurance policy is necessary, the types of protection offered, and just how to pick the ideal plan can be critical in guaranteeing your most significant investment remains safe and secure.Given the importance of home insurance coverage in shielding homeowners from unanticipated monetary losses, it is crucial to comprehend the different types of protection readily available to tailor a plan that suits private demands and circumstances. San Diego Home Insurance. There are numerous crucial kinds of insurance coverage provided by linked here a lot of home insurance coverage plans.Choosing the suitable home insurance coverage plan entails cautious consideration of different vital elements to make sure thorough insurance coverage tailored to private requirements and circumstances

Report this wiki page